A drop in independent veterinary practices may be causing pet owners to overpay for treatments and medicines, according to a watchdog investigation.

The Consumer and Markets Authority (CMA) report has flagged that lack of access to information about treatments and weak competition due to large corporations buying up independent vets may be causing the spike in vet bills.

In 2014 90% of vets were independent practices, a figure which has fallen to just 40% today.

Rita Dingwall, the business development manager for the Federation of Independent Veterinary Practices (FIVP), said: “The spread of corporate-owned, profit-oriented practices across the country will mean that veterinary costs continue to soar.

“This consolidation also increases the practices’ purchasing power, allowing them to negotiate medicine prices which independent practices couldn’t possibly achieve. Independent practices could feel pressured to increase their own prices, as they compete with corporate groups for recruitment and medicines.”

The FIVP said that the CMA report highlights the “devastating effect” the increasing concentration of corporate-owned practices has on the veterinary industry.

There are 48 Greater Manchester veterinary services listed on the Royal College of Veterinary Surgeons website. More than half of those (28) are operated by the two large vet groups CVS and Pets at Home. The CVS group operate their veterinary practices under different names as part of their vets collection umbrella.

The Manchester figure mirrors the concentration of vets now operated by large groups nationally. CVS, IVC, Linnaeus, Medivet, Pets at Home, and VetPartners now own nearly 60% of vet practices in the UK.

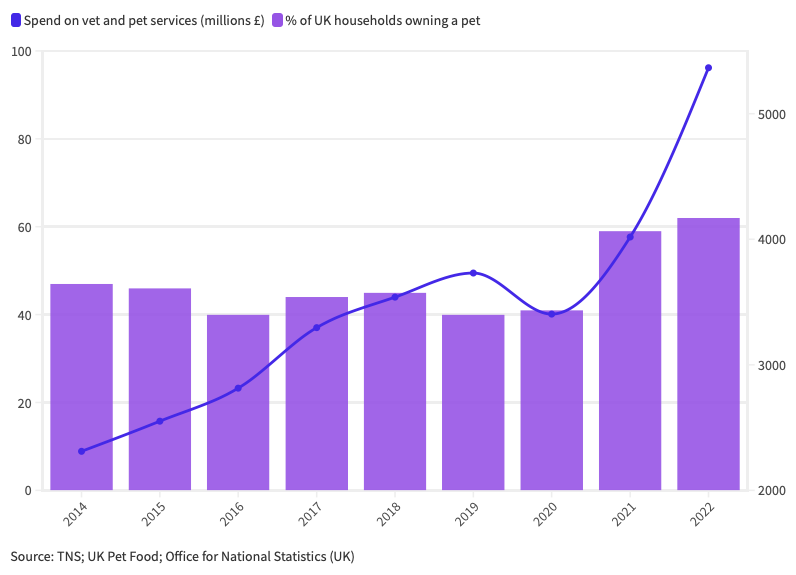

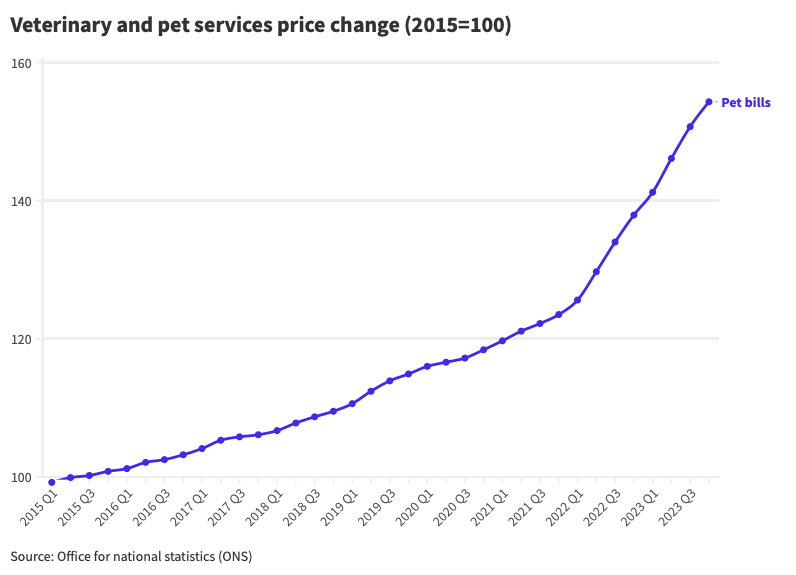

The CMA report will be welcome news to pet owners hit by the rising cost of veterinary care with prices rising faster than inflation and increasing especially quickly after the boom in pet ownership during the pandemic.

A recent Pearson Ham Group report revealed a “significant” 13% increase in pet insurance prices over the past year.

CVS Group says it has “engaged constructively” with the CMA throughout its review into the industry. In a press release the group claim to have proposed solutions to the issues raised by the CMA.

A company spokesperson said: “CVS along with certain other corporate groups who together own around 50% of First Opinion Practices in the UK, has already engaged constructively with the CMA and put forward a package of possible remedies to address its concerns. CVS continues to believe this package could be adopted across the market and could address the CMA’s concerns more quickly than an 18-month investigation.”

The price of shares in CVS group have fallen 40% since the CMA report was published.